capital gains tax canada real estate

Its only since 2000 that the inclusion rate dropped again to 50. It is necessary to buy a new property within a year of the sale or two years after the sale to save taxes.

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Do not include any capital gains or losses in your business or property income even if you used the property for your business.

. Contact us today for a FREE initial consultation appointment at infotaxpartnersca or by phone at. For more information see Completing Schedule 3. The taxes must be paid on 50 of the gain at the marginal tax rate.

Theres little stopping the capital gains tax from rising again especially if the government needs increased revenue to pay its debt. Had this home been a primary residence you would only owe tax on 50 of the capital gain. The Canadian government hasnt discussed a capital gains tax on real estate but the industry is already fighting it.

Toronto Regional Real Estate Board TRREB sent a memo to their members this week. It then rose to 50 until 1990 when it rose again to 75. In other words the entire capital gain the income recognized from a US perspective is subject to tax at an effective rate of 26765.

This means that you would owe capital gains taxes on the 75000 increase in capital. You must pay taxes on 50 of this gain at your marginal tax rate. This real estate capital gains calculator should be used to estimate the capital gains tax you may pay if you sell your home or land or any other capital asset.

You sell the condo in 2022 for 250000. Sale of farm property that includes a principal residence Only part of your capital gain may be taxable. If you sell a property for more than you bought it for you will be taxed on 50 of the difference in value.

If you donated certain properties to a qualified donee you will also have to complete Form T1170 Capital. Assume a USD500000 CAD658000 gain on the sale of a Florida vacation property. Pay Capital Gains Tax When Selling The Property.

When you sell a capital property for more than you paid for it this is called a capital gain. The capital gains tax has always been fluid. For each real property you sold in 2021 that includes land and a building you must.

2022 free Canada income tax calculator to quickly estimate your provincial taxes. Selling a building Special rules may apply if you sold a building for less than its cost amount and its capital cost. Tax Partners is well respected among investors and lenders that rely on our independent accounting and tax services involving financial statements of our real estate clients.

Does capital gains tax apply only to real estate. You may have to report a capital gain if you change your principal residence to a rental or business property or vice versa. In Canada the capital gain inclusion rate is 50 which means when a capital asset is sold for more than it was paid for the CRA applies a tax on half 50 of the capital gain amount.

If you choose not to or cannot pay this the value will be taken from the deceaseds estate. Heres a simplified example. The CRA can charge capital gains tax on anything you sell that makes a profit including stocks bonds real estate investments and other assets most retirement accounts in Canada however allow you to defer paying taxes on gains until you actually withdraw the money you made.

The calculator based on your input. March 25 2021. For instance if you buy a property as an investment and then sell this property making 100000 in.

Real estate includes the following. In the province of Ontario the highest marginal rate is 5353 that bracket is reached for incomes in excess of 220000. You may have a capital gain or loss when you sell a capital asset such as real estate stocks or bonds.

In the memo they explain why theyve taken an aggressive position against the yet to be proposed tax. A homeowner can qualify for an exemption from long-term capital gains taxes through section 54 if their gains are reinvested into other properties. Rental property both land and buildings farm property including both land and buildings other than qualified farm or fishing property commercial and industrial land and buildings.

For now the inclusion rate is 50. The inclusion rate refers to how much of your capital gains will be taxed by the CRA. Your tax rate is 0 on long-term capital gains if youre a.

Once you have realized your capital gains off of an investment asset you need to pay taxes on them as well. Aero precision m5 receiver set lake arrowhead ohv hmofc comcast meaning. It didnt exist before 1972.

You buy a condo in 2020 for 200000. The taxes in Canada are calculated based on two critical variables. Use Schedule 3 Capital gains or losses to calculate and report all your capital gains and losses.

Your income tax rate bracket is determined by your net income which is your gross income less any contributions to registered investment accounts. Even someone with a high income will only pay 27 tax at most on their capital gains 54 top tax rate in Nova Scotia times 50 inclusion rate. Capital gains and losses are taxed differently from income like wages interest rents or.

Get better visibility to your tax bracket marginal tax rate. In Canada 50 of the value of any capital gains are taxable. Those with incomes above 501601 will find themselves getting hit with a 20 long-term capital gains rate.

The capital gains tax rate in Canada can be calculated by adding the income tax rate in each province with the federal income tax rate and then multiplying by the 50 capital gains inclusion rate.

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Understanding Taxes And Your Investments

Capital Gains Tax In Canada Explained

Canada Capital Gains Tax Attribution Rules In Canada Versus The Us

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Canada Capital Gains Tax Calculator 2022

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

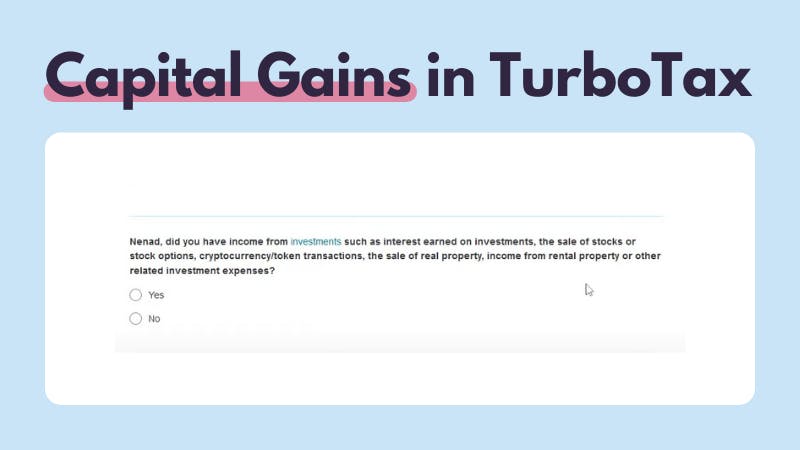

How To Do Your Turbotax Canada Crypto Taxes In 2022 Koinly

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Understanding Capital Gains Tax In Canada

Common Usa Tax Forms Explained How To Enter Them On Your Canadian Tax Return 2022 Turbotax Canada Tips

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Inheriting A Secondary Residence Some Planning May Be Required Sfl Wealth Management Sfl Investments

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Capital Gains Tax In Canada Explained Youtube

6 Ways To Avoid Capital Gains Tax In Canada Reduce Capital Gains Tax Canada Youtube

How Low Taxes Lead To High Home Prices In Vancouver Bc Sightline Institute